I will show you where you probably lose a lot of money and list tips on how to save money. This article is based on two researches, one before and one during the pandemic. However, I can already say: You could save so much more.

Where you probably spend a ton of money

The first survey dates back to mid 2019 and asked americans about their spending habits, which revealed some stunning facts:

Non-essential monthly spends

- Dinner out at a restaurant $209.38

- Drinks out with friends or co-workers $188.68

- Takeout or delivery $177.88

- Purchasing lunch $173.62

- Impulse purchases $108.97

- Use a rideshare (for non-essential trips) $96.11

- Receive personal care $94.25

- Subscription boxes $93.96

- Cable $90.57

- Online shopping (for non-essentials) $84.11

- Gym, fitness classes and/or a personal trainer $72.53

- Paid apps $23.24

- Streaming services for movies/TV $23.09

- Streaming services for music $22.41

- Coffee $20.25

- Bottled water $17.47

In addition, there are other areas like insurance, debt, credit cards, car, car repairs and more that add up. In fact, I highlighted in my other article What means frugal and how do I become frugal that a lot of people live paycheck to paycheck.

Americans feel they can’t afford

- Putting money into a retirement account 38 %

- Life insurance 35 %

- Paying off my credit card(s) 28 %

- Car repairs 26 %

- Owning a car 24 %

As you can see, spending can be a problem. There are aspects of life, like saving money, which get compromised because of unnecessary spending.

I know this exactly because I once was in this spot. I didn’t think about the future, only the present and therefore wasted tons of money on non-essentials.

What changed the pandemic in terms of spending money

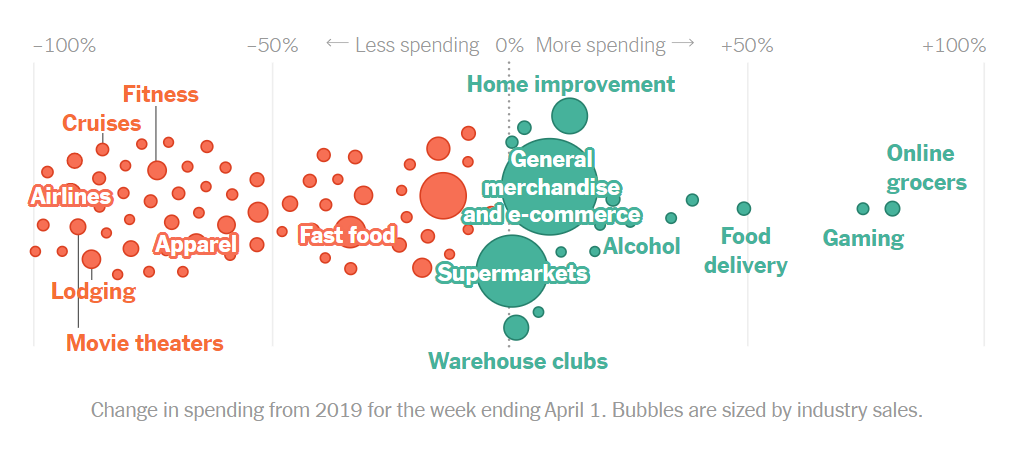

The second study from The New York Times shows that because of the pandemic, some behaviors changed. Nonetheless, it seems that people haven’t really saved so much money because of it, but redirected their spending to other areas.

While a gym membership might not have been renewed, other areas rose like food and entertainment. In addition, spending increases in electronics and home improvement are not surprising.

Why I took both surveys, 2019 and 2020

As I researched the numbers, I thought about past pandemics and their impact. This is how I got to the report from the World Economic Forum, which in summary states that we will probably forget Covid. In fact, history tells that there were three pandemics in the 20th Century: The spanish flu (1918), the Asian flu (1957) and the Hong Kong flu (1968). All of them killed millions, but we only vaguely remember the biggest one in 1918. Covid is in the same league as the two asian flu(s) and it is therefore likely that this will soon be forgotten.

This is the reason why I chose both surveys, since I think that we will return somewhat to the spending of 2019.

How to save money

Take again a look above where I listed the non-essential monthly spends and reflect on how this looks in your life.

Make a budget and TRACK everything

- Every penny you use is a penny less. Track every cent and keep control over your finances

- Avoid impulsive buying

- Lower the limit of your credit card or don’t use it at all

- I have for instance a Prepaid Card, so that I have to recharge.

Decide where you want to spend

- You should know how much you spend as you did track everything

- Decide where you want to save money

- Fix a budget for yourself to follow

- Cut your Food, bills, electricity, mobile, subscriptions etc.

- Again, track everything

If you want to eat healthy and good, then check out my article Save money and eat healthy, the guide – Yes, it’s possible

Set up an emergency fund

- Put aside a fixed amount of money. Make an automatic execution, since you will not do it always

- After that, invest monthly.

Invest

- This article from the Swiss bank Postfinance explains the first steps to invest and clears more questions. In addition, I recommend reading the other articles too (is in English).

- Here are the key points

- The higher the risk, the greater the chance of making gains.

- Diversity is key – invest in multiple areas and countries

- Investing money regularly does cancel short price fluctuations

- I found this Risk profile check from a bank. Might help you to see how to invest. (Its in German, but use Google to translate it)